Breakdown of Vocational Training Career Paths

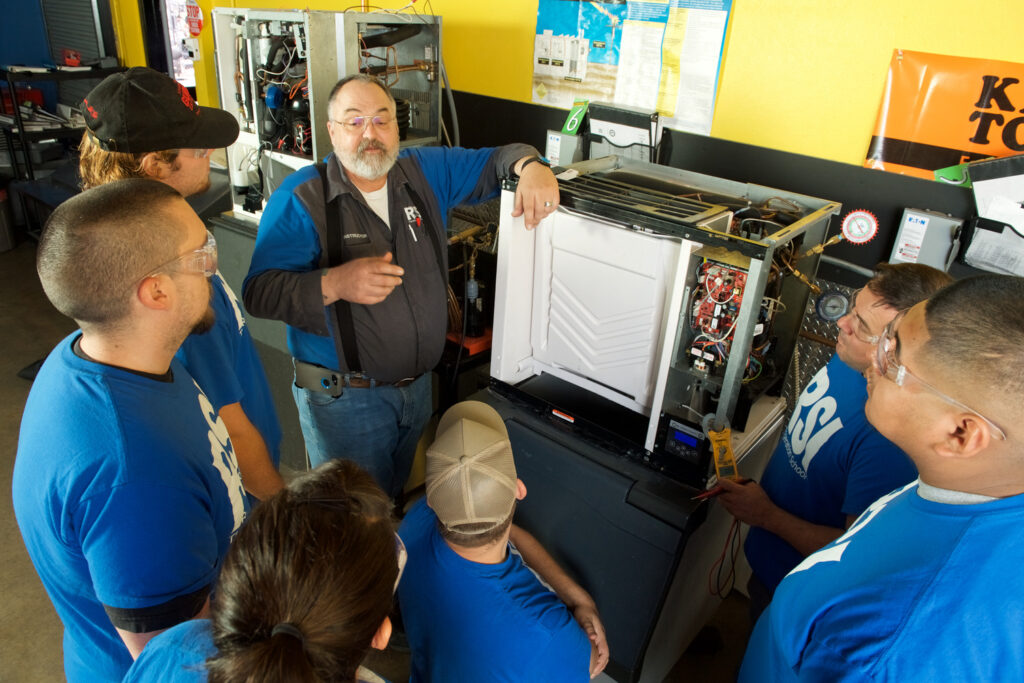

Four-year college isn’t the only option to advance a career. If you prefer working with your hands, learning by doing, and getting into the workforce sooner, vocational training offers a straightforward and rewarding path. The Refrigeration School, Inc. (RSI) in Phoenix, Arizona, offers […]

Read More about Breakdown of Vocational Training Career Paths